About Accounts

How it works

Boom Community Bank members can apply for an Engage pre-paid Visa debit card. Control your spending by choosing the amount to load, use the contactless card in stores and online, and earn cashback rewards when you shop.

Good to know

- No credit checks.

- No overdraft, so no overdraft fees.

- UK-based customer service support 6 days a week.

- Monthly fees: Classic Account: £2.30, Premium Account: £5.29

- Earn cashback rewards of up to 15% when you shop at major retailers.

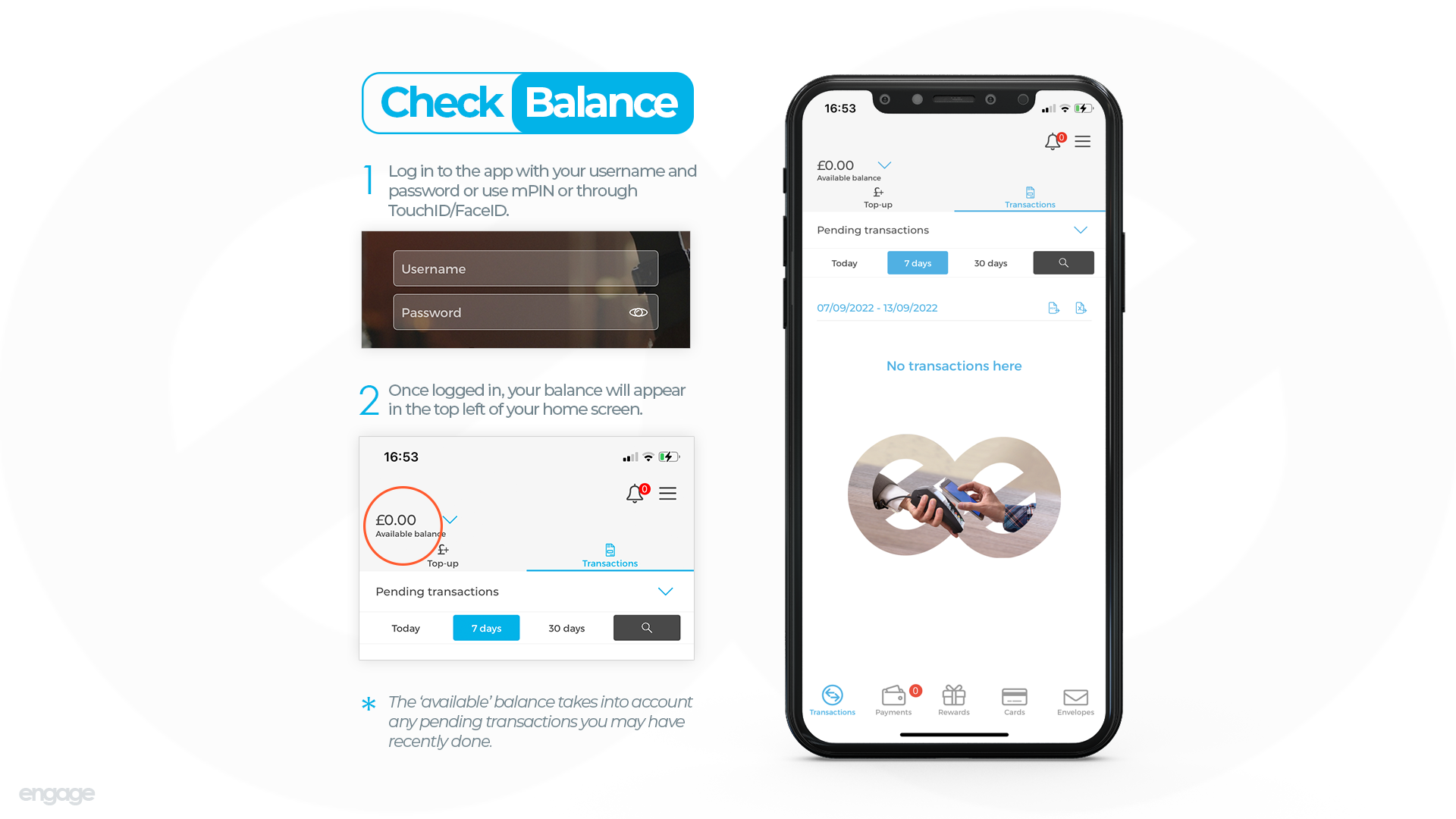

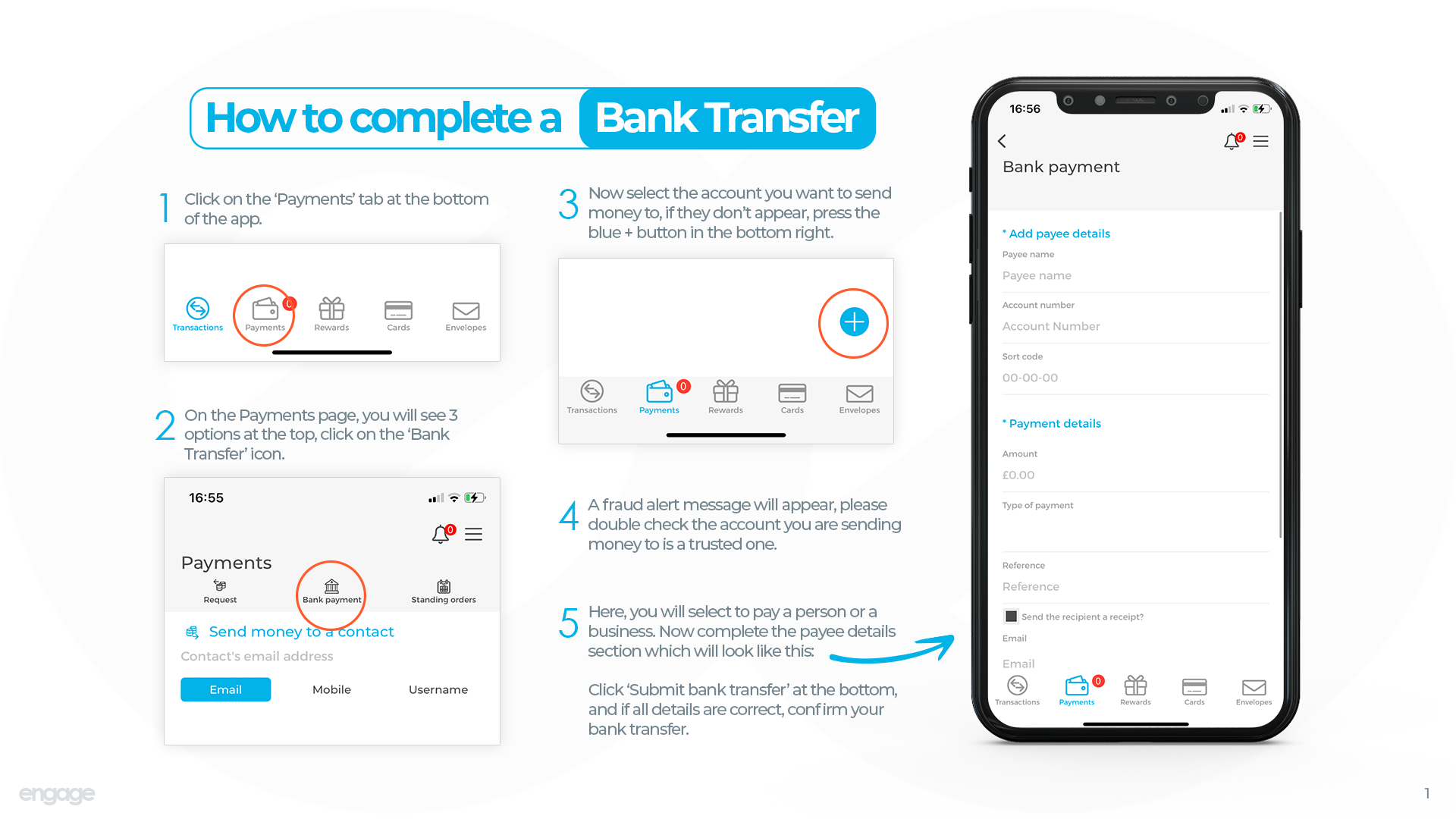

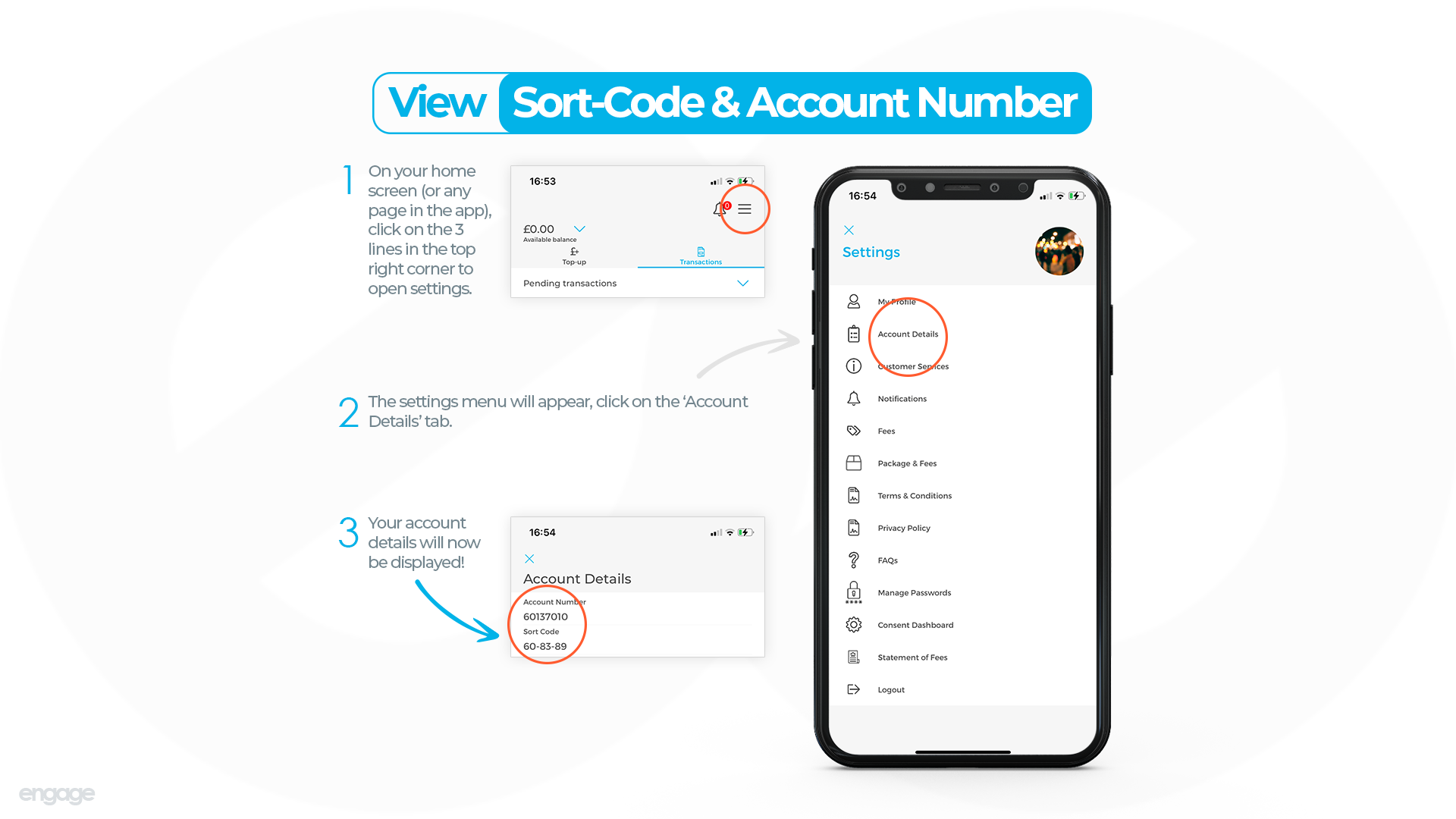

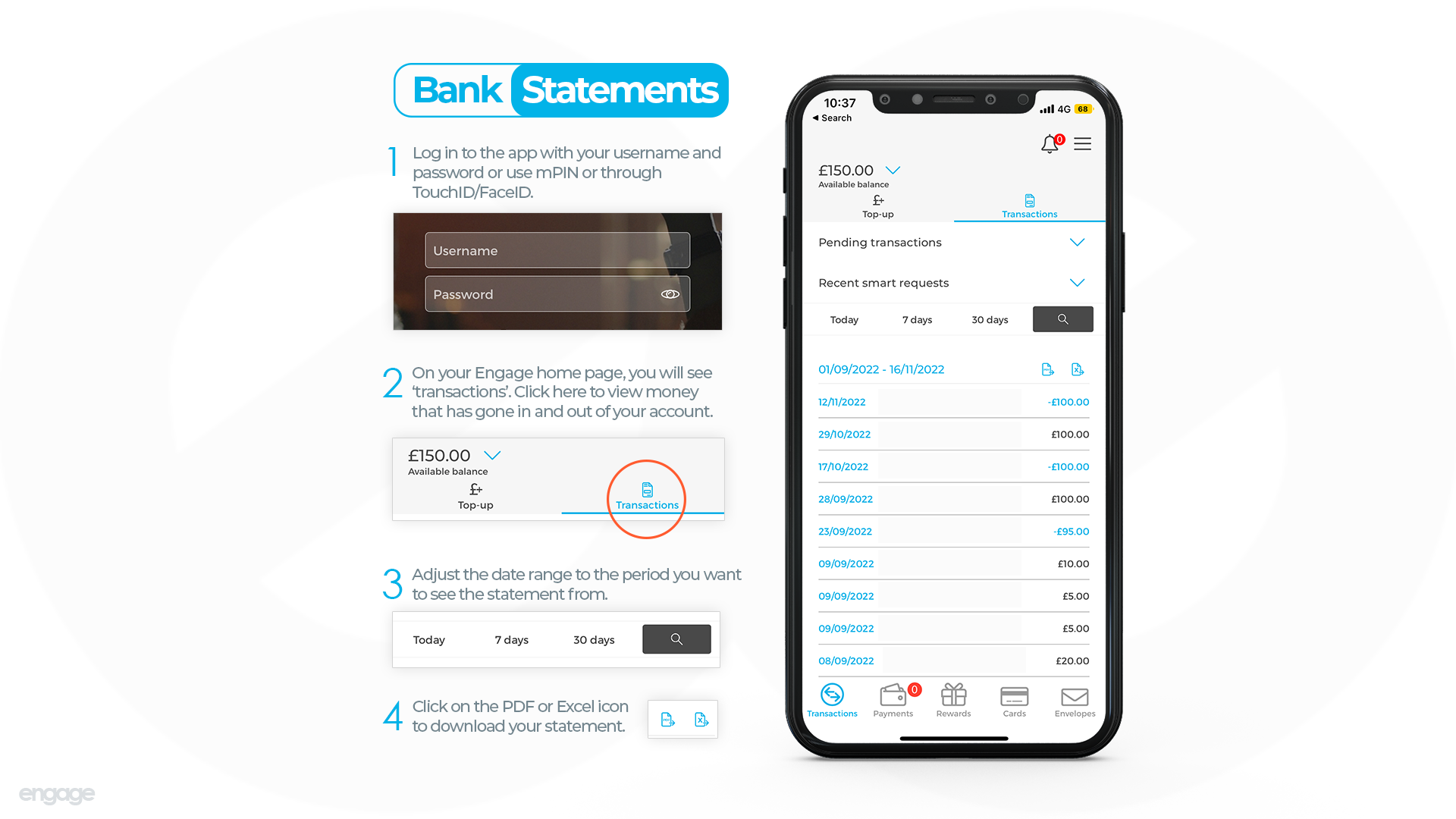

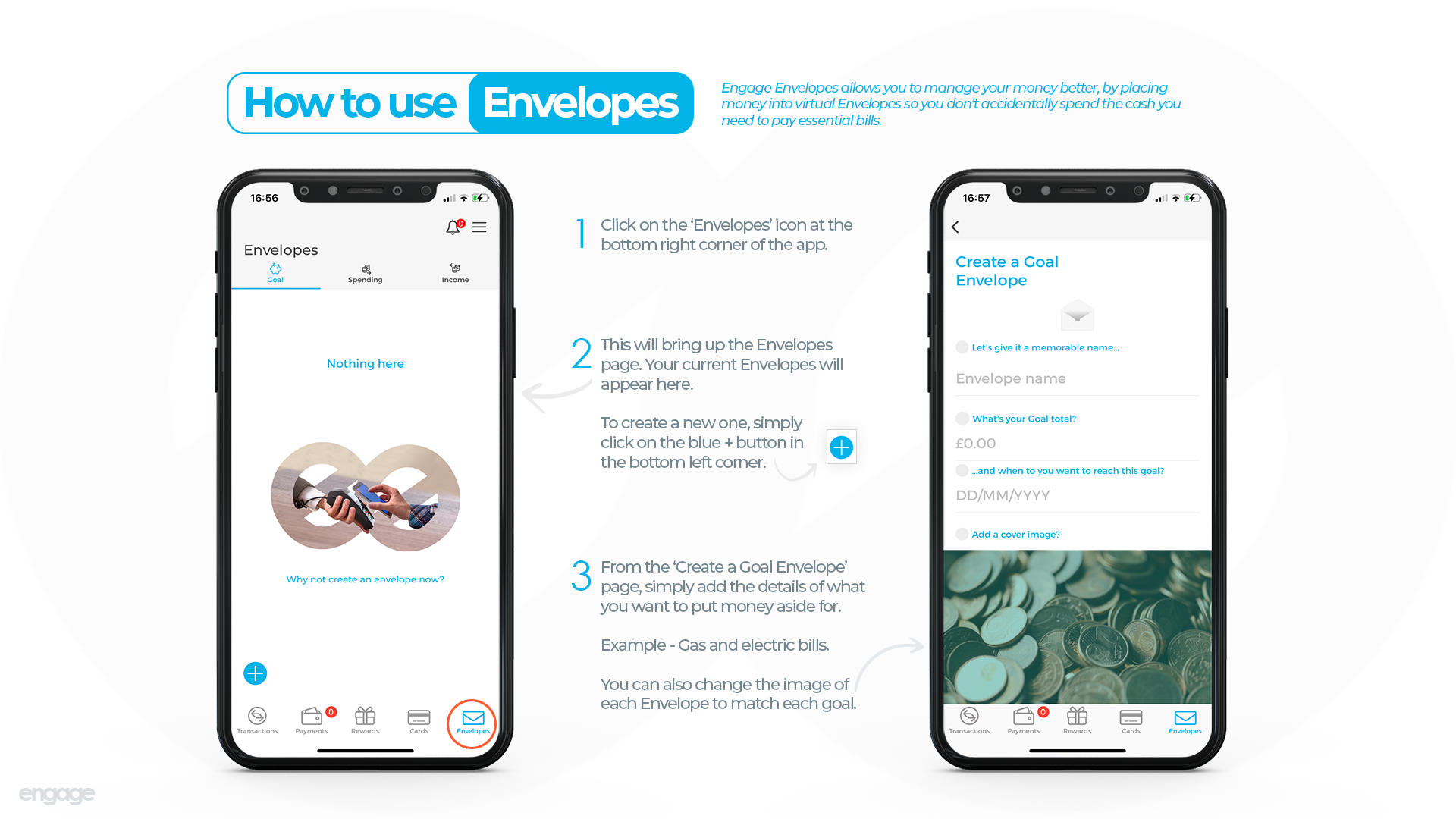

- Download the app for 24/7 access and free budgeting tools.

Eligibility

Must be a UK Citizen or have indefinite leave to remain, and live or work in West Sussex, Surrey, Berkshire, Kingston upon Thames, North Hampshire (Basingstoke and Deane, Hart, and Rushmoor Districts), South Bucks and Wycombe Districts, and South Oxfordshire District.

* Other usage fees may apply, depending on how the card is used. Please see the terms and conditions for full details.

Please note that Engage is an electronic money product and although it is a product regulated by the Financial Conduct Authority, it is not covered by the Financial Services Compensation Scheme, however, Engage ensure that any funds received from you are held in a segregated account so that in the unlikely event that Contis Financial Services Ltd. becomes insolvent your funds will be protected against claims made by creditors.

Find out more

Frequently asked questions